STAFFORD, Va. -- The idea of collecting $1.4 million next year to manage storm water ponds didn’t sit well with Stafford County leaders, so they proposed to collect half as much and sort out the details later.

The Stafford County Board of Supervisors set an advertised tax rate of $1.019 for every $100 of assessed property value. Those property taxes on homes largely fund Stafford’s $261.4 million budget for fiscal year 2015 that takes effect July 1.

There would be no change, however, in local schools as the division would still receive $139.4 million transferred to it as part of the budget, to cover operating and debt service costs. The rate is .007 cents higher than the original rate presented by County Administrator Anthony Romanello in his proposed budget to the Board of Supervisors in March.

This article is FREE to read. Please Sign In or Create a FREE Account. Thank you.

Recent Stories

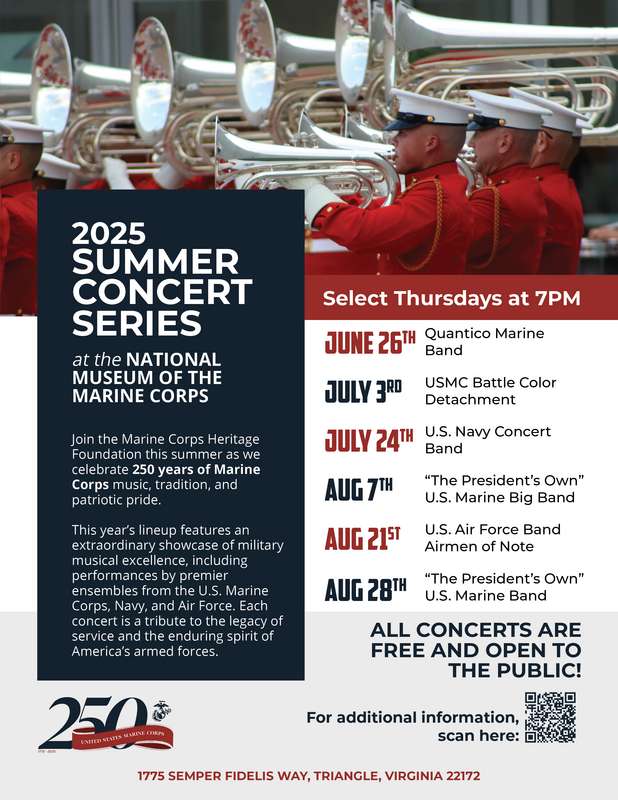

A summer tradition returns to Northern Virginia with a patriotic lineup of performances from some of the nation’s top military ensembles. The 2025 Summer Concert Series at the National Museum of the Marine Corps continues on Thursday, July 3, with a performance by the U.S. Marine Corps Battle Color Detachment.

The ArtsFairfax Events Calendar is your destination for all arts and culture activities in Northern Virginia. Find a concert, play, poetry reading, or exhibition in your neighborhood—many events are free and family-friendly!

Are you part of a performing arts group, school, or cultural organization? You can add your events and classes, too. The ArtsFairfax Events Calendar is free and easy to use.

Your attendance at local arts events supports small businesses in our community and the art makers who help make Fairfax and its surrounding region so vibrant. With the ArtsFairfax Events Calendar, you can stay curious and stay local to plan your next arts adventure!

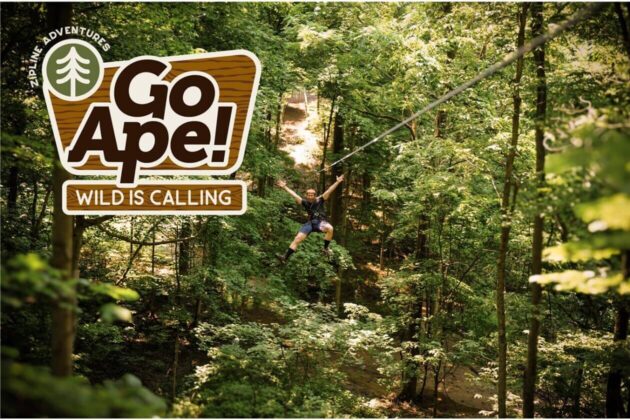

Go Ape, America’s leading aerial adventure park provider, is proud to unveil a revitalized experience across its iconic Zipline & Adventure Parks. This refresh goes beyond physical upgrades; it reflects a renewed mission to foster meaningful connections between people, nature, and self.

“Go Ape has always been about thrilling treetop adventures,” says Chrissy Very, Senior Director of Marketing. “Now, we’re redefining what it means to truly connect: through purpose-driven outdoor experiences that inspire courage, reflection, and joy.”

As access to public outdoor spaces becomes more limited, Go Ape steps in to bridge the gap with immersive, inclusive, and wellness-focused adventures for individuals, families, and groups.

Christmas in July

Volunteer Prince William will be holding a fun-filled Christmas in July event at Heritage Brewing Co on July 26th from 12pm until 6pm with all proceeds going to support the 2025 Untrim-A-Tree and Senior Basket Program. Untrim-A-Tree and Senior Basket

Your Weight Matters National Convention

Hosted by the Obesity Action Coalition (OAC) since 2012, this highly-anticipated gathering is the nation’s leading gathering focused on empowering individuals with science-based education, support and practical tools for managing weight and improving health.

This unique Convention truly has something