By Christine Stoddard and Daniel Lombardo

Capital News Service

RICHMOND, Va. – Bid farewell to tax-free buys from the world’s most popular online store.

Amazon.com, the Seattle-based e-tailer of books and other products, next year will begin collecting and paying Virginia state sales tax under an agreement announced by Gov. Bob McDonnell.

McDonnell made the announcement as the General Assembly gave final approval to Senate Bill 597, which expands on an existing state law requiring online businesses with facilities in Virginia to pay the state’s 5 percent sales tax.

“This bill helps to ensure that online retailers with a physical presence in Virginia are treated the same as traditional brick-and-mortar retailers who are already required to collect and remit existing sales taxes on goods sold in the commonwealth,” the governor said.

McDonnell said his office, legislators, Amazon and traditional retailers had reached an agreement on the legislation. Amazon has pledged to collect sales tax on goods bought by Virginians beginning Sept. 1, 2013. (The effective date could move to Jan. 1, 2014, if Congress adopts federal legislation governing sales tax collections by online businesses.)

Sen. Frank Wagner, the sponsor of SB 597, said Virginia can expect to gain at least $23 million in tax revenues from Amazon in 2013 alone.

“As Black Friday and Cyber Monday have shown in recent years, the Internet retail sector is a fully developed and thriving member of the community of retail merchants,” Wagner said. “I’m glad to have sponsored this legislation that provides a level playing field for both brick-and-mortar retailers as well as those on the Internet.”

Rob Shinn of the Virginia Alliance for Main Street Fairness, which represents hundreds of retailers, called the agreement “a significant step toward tax fairness for the retail community by ensuring the same rules apply to all retailers doing business in Virginia.”

Traditional stores maintained that Amazon should have been paying sales taxes all along.

A press release from Virginia Retail Merchants Association stated, “State law requires that online retailers with a physical presence in the commonwealth collect sales tax on purchases from individuals with a Virginia address, but Amazon has been using a loophole to avoid those taxes.”

Amazon runs a warehouse in Sterling and a data center at an undisclosed site in Virginia. But the company got around the state law by creating a separate subsidiary to handle distribution – and the Virginia Department of Taxation ruled in 2007 that Amazon was not required to collect and remit sale taxes.

When e-tailers don’t collect sales tax, state law requires Virginia purchasers to include the tax in their state income tax return. But most people don’t, officials say.

The Virginia retail industry has been lobbying the state government to require Amazon to collect sales tax. The issue came to a head after Amazon announced plans to open distribution centers in Chesterfield and Dinwiddie counties in late 2012. The centers, which would employ a total of 1,350 people, represent a combined investment of $135 million.

The eastern Chesterfield center will measure 1 million square feet and be located at Meadowville Technology Park. The Dinwiddie center will be located at Dinwiddie Commerce Park.

The state offered Amazon incentives to locate the distribution facilities in Virginia. The Governor’s Opportunity Fund will provide $3.5 million for the centers, while the Virginia Tobacco Indemnification and Community Revitalization Commission will contribute $850,000.

Traditional retailers groused about the deal because of Amazon’s refusal to collect sales tax.

“They’ve gone to great lengths to avoid it; this is kind of part of their business model,” said Laurie Aldrich, president of the Virginia Retail Merchants Association.

“Every time they went to open up a distribution center or a warehouse, they tried to set up their corporation where they could avoid collecting the tax. In 2007 in Virginia, they went and asked if they would be required to collect a tax if they set up their corporate structure a certain way.”

As a result, Virginians have been avoiding sales tax – and essentially getting a 5 percent discount – by buying products from Amazon instead of from a brick-and-mortar retailer.

“Retailers are not afraid of competition. They all want to be playing by the same rules,” Aldrich said. “It was really just an unfair advantage.”

After McDonnell announced the agreement on SB 597, the bill was approved 95-2 by the House of Delegates and 37-3 by the Senate. The legislation now goes to the governor to be signed into law.

Amazon says it supports the bill.

“Amazon is very grateful to Gov. McDonnell for his focus on Virginia jobs and for his efforts to work with other governors toward national resolution of the sales tax issue this year,” Paul Misener, the company’s vice president of global policy, said in a statement.

Amazon currently collects state sales tax in Washington, Kentucky, North Dakota, Kansas and New York.

Aldrich also is glad that Amazon will collect and remit sales taxes from Virginians.

“Now they’re going to have to play by the same rules as everyone else,” she said.

Recent Stories

The Stafford County Board of Supervisors faces a looming decision on the Clift Farm proposal by Jarrell Properties, Inc., which seeks to rezone 57 acres from Agricultural to Urban Residential – Medium Density. The development area, located on Clift Farm Road, just off Leland Road in the Falmouth District, plans for 141 age-restricted homes.

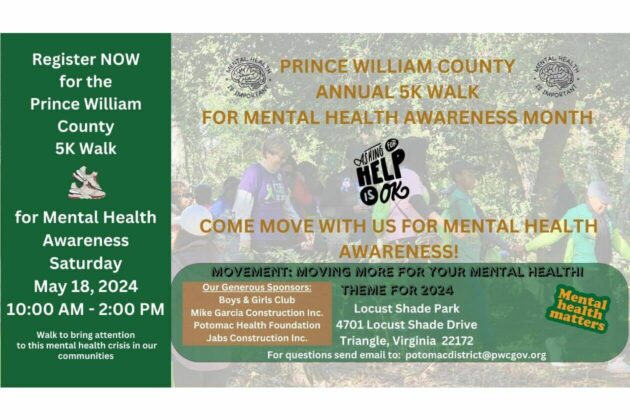

We are honored to have the Honorable Andrea O. Bailey of the Potomac District, along with the esteemed leadership of Prince William County, hosting our 4th Annual 5K Walk for Mental Health Awareness. This event is a testament to their commitment to educate, advocate for, and dispel myths and stigma surrounding mental illness.

Dust off your running or walking shoes, bring your pets, and move with us in this county-wide FREE event in recognition of Mental Health Awareness Month on Saturday, May 18th, from 10:00 am to 2:00 pm. This year’s theme is Movement: Moving for Your Mental Health.

We will walk along a scenic multi-purpose trail in a wooded setting with sufficient signage to meet the needs of the walkers at Locust Shade Park, 4701 Locust Shade Drive, Triangle, Virginia 22192.

Are you feeling overwhelmed by life’s challenges? Struggling with anxiety, depression, or unresolved trauma? Take the first step towards healing and reclaiming your life with our professional psychotherapy services.

At Peaceful Mind Solutions, we understand that mental health is just as important as physical health. Our team of compassionate and experienced therapists is here to provide you with the support and guidance you need on your journey to mental wellness.

Through personalized therapy sessions, we create a safe and non-judgmental space where you can explore your thoughts, feelings, and experiences. Whether you’re dealing with past traumas, relationship issues, or simply seeking personal growth, we tailor our approach to meet your unique needs and goals.